Edited & Reviewed by: Taranjit Singh

Have you ever felt the urge to anticipate the twists and turns of the financial markets? Technical analysis, a cornerstone of many traders' strategies, equips them with a roadmap for navigating this ever-changing environment. Candlestick charts, with their visual portrayal of price movements, serve as a key tool in this analysis. Imagine condensed bars and wicks summarizing a wealth of information – that's the power of candlestick charts.

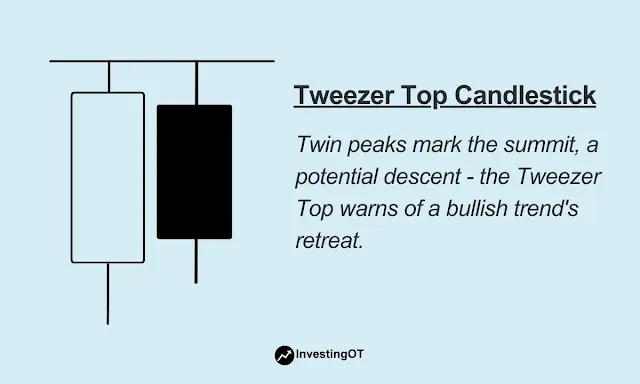

The Tweezer Top pattern stands out prominently within this charting landscape. It functions as a potential warning sign, signaling a crucial reversal from an uptrend to a downtrend. By mastering the identification and interpretation of this pattern, you can gain a valuable advantage in the fast-paced world of trading, allowing you to make informed decisions based on technical insights.

Key Takeaways

- Downtrend Signal: Tweezer Top suggests a trend reversal from up to down.

- Twin Peaks & Confirmation: Look for 2 candles with equal highs, then a price drop below the low of the second candle for confirmation.

- Strength & Volume: A stronger uptrend and higher volume on a bearish candle signal a stronger reversal.

- Entries & Exits: Enter on a break below low, exit on profit targets or price reversals.

- Stop-Loss & Limitations: Use stop-loss, be aware of false signals, and combine with other indicators.

- Double Top vs. Tweezer Top: Double Top has separate highs, and Tweezer Top has near-identical highs.

- Probabilistic Indicator: Not a guarantee, use with other analyses for better decisions.

Identifying the Tweezer Top

Now that we've identified the Tweezer Top as a potential trend-reversal sign, let's delve into its defining characteristics. This pattern is all about twin peaks, formed by two consecutive candlesticks. Here's a breakdown of what to look for:

- The Uptrend Precursor: The Tweezer Top emerges at the peak of an uptrend. The first candlestick within the pattern will reflect this upward movement, typically a bullish candle like a green rectangle on a price chart.

- The Twin Peaks Arrive: The key element is the appearance of two candles with nearly identical highs. Imagine two mountain peaks reaching almost the same elevation – that's the visual representation we're looking for. The second candlestick, often a bearish red candle, might have a slightly different body size, but its high point should be very close to the first candle's high.

Visualizing the Tweezer Top:

Confirmation of the Tweezer Top

While spotting a Tweezer Top on your charts is a good first step, it's crucial to remember that confirmation is essential for a truly reliable signal. Here's why:

Imagine the market as a story with plot twists. The Tweezer Top itself hints at a potential change in direction, but it doesn't guarantee it. Confirmation acts as the next chapter, solidifying the shift in momentum.

So, what confirms a Tweezer Top? We're looking for a downward price movement following the second candlestick of the pattern. This price drop signifies that the bears (sellers) are gaining control, potentially pushing the price down and reversing the previous uptrend.

The stronger and more sustained this downward movement, the more confidence you can have in the Tweezer Top's validity as a reversal signal. This confirmation strengthens the message – a potential shift from an uptrend to a downtrend is becoming increasingly likely. By waiting for confirmation, you are taking a cautious approach, avoiding potentially misleading signals, and making more informed trading decisions.

Strength of the Tweezer Top

Not all Tweezer Tops are born equal. While they all signal a potential trend reversal, some carry more weight than others. Here's how to assess the strength of a Tweezer Top:

- The Uptrend's Footing: The strength of the preceding uptrend significantly impacts the Tweezer Top's significance. A well-established, robust uptrend followed by a Tweezer Top suggests a potentially stronger reversal. Conversely, a Tweezer Top emerging from a weaker uptrend might indicate a less impactful or even false signal.

- Volume Speaks Volumes: Trading volume plays a crucial role in confirming the Tweezer Top. Higher volume on the second (bearish) candle strengthens the reversal message. This surge in volume signifies increased selling pressure, supporting the notion that the bears are overpowering the bulls and pushing the price down. Lower volume on the bearish candle, however, weakens the signal, suggesting a lack of conviction from sellers and potentially a less reliable reversal.

Trading with the Tweezer Top

The Tweezer Top, when properly identified and confirmed, can be a valuable tool for traders seeking to capitalize on potential trend reversals. Here's how to approach trading with this pattern, incorporating insights from experienced traders:

Entry Points:

- Break Below the Low: A common entry point for a sell trade occurs when the price dips below the low of the second candlestick in the Tweezer Top pattern. This signifies a confirmed downtrend, and traders can enter short positions anticipating further price decline.

Exit Points:

- Profit Targets: Profit targets can be set based on various technical indicators or chart patterns that signal potential support levels for the price. Experienced traders often recommend setting profit targets that align with established support levels, such as moving averages or Fibonacci retracement levels. This helps to lock in profits while avoiding greed and holding onto a trade for too long.

- Price Reversal: If the price starts to move back up and decisively breaks above the first candlestick's high, it might indicate a weakening downtrend. Traders can consider exiting their short positions to avoid further losses. Some experienced traders also advise using trailing stop-loss orders to automatically exit a trade if the price starts to move against them, further mitigating potential losses.

Stop-Loss Placement:

- Risk Management: Placing a stop-loss order above the high of the Tweezer Top pattern is crucial for risk management. This limits potential losses if the price unexpectedly rallies, invalidating the reversal signal. The placement of the exact stop-loss can vary based on the trader's risk tolerance and the asset's volatility. Some experienced traders recommend setting the stop-loss a few points above the high of the Tweezer Top, while others might use a wider stop-loss based on their risk appetite.

Remember: The Tweezer Top is a probabilistic indicator, not a guaranteed prediction. Always prioritize risk management and consider using the Tweezer Top in conjunction with other technical analysis tools for a more comprehensive trading strategy. By combining the Tweezer Top with other indicators like volume confirmation or moving average crossovers, traders can increase their confidence in the signal and make more informed trading decisions.

Tweezer Top vs. Double Top

The Tweezer Top and Double Top are two technical analysis patterns that both hint at a potential shift from an uptrend to a downtrend. While they share some common ground, understanding their key differences is crucial for accurate interpretation.

On the one hand, both patterns are reversal signals and involve two candlesticks. They also focus on the highs of the candlesticks, reflecting a potential battle between buyers and sellers.

However, the way they form these highs is distinct. The Tweezer Top features two candles with almost identical highs, like twins. The Double Top, in contrast, showcases two separate highs with a clear price dip separating them, resembling a valley between two mountains.

Confirmation also differs between these patterns. The Tweezer Top typically seeks a strong confirmation in the form of a price movement decisively below the low of the second candlestick. Double Tops, on the other hand, might find confirmation through a price drop breaching a support level drawn beneath the lows of the two peaks, often referred to as the neckline.

In terms of strength, the Double Top generally holds more weight as a reversal signal. This is due to its more pronounced double peak formation compared to the subtle twin peaks of the Tweezer Top.

By grasping these similarities and key differences, traders can learn to distinguish between the Tweezer Top and the Double Top, refining their ability to interpret potential trend reversals within their technical analysis strategies.

Examples of Tweezer Tops in Action

The Tweezer Top's ability to signal potential trend reversals can be a valuable asset for traders. Let's delve into the world of Microsoft (MSFT) and explore a successful Tweezer Top alongside a false signal, showcasing the pattern's potential and limitations in a real-world setting.

This successful Tweezer Top on the MSFT chart potentially helped traders anticipate a downtrend, allowing them to adjust their positions accordingly.

This example highlights the possibility of false signals with the Tweezer Top. It emphasizes the importance of using the pattern in conjunction with other technical indicators and market context for a more comprehensive understanding.

Can the Tweezer Top occur in downtrends?

No, the Tweezer Top specifically appears at the peak of an uptrend. It signals a potential shift towards a downtrend. By definition, it wouldn't occur in an already established downtrend.

How long does a Tweezer Top signal last?

The duration of a trend reversal signaled by a Tweezer Top can vary significantly. It depends on various factors like the overall market strength, the asset's volatility, and other technical indicators. The Tweezer Top itself doesn't provide a specific timeframe. However, some traders look for additional confirmation signals to gauge the potential length of the downtrend.

Conclusion

The Tweezer Top has emerged as a valuable companion for traders seeking to identify potential trend reversals. By recognizing its characteristics, understanding its strengths and limitations, and using it alongside other technical indicators, you can leverage this pattern to make informed trading decisions. Remember, the Tweezer Top is a probabilistic indicator, not a crystal ball. However, by incorporating it into your trading strategy, you gain an additional tool to navigate the ever-changing market landscape. So, sharpen your chart analysis skills, identify those twin peaks, and harness the power of the Tweezer Top!