Ever feel like navigating the financial markets is akin to deciphering ancient hieroglyphics? You're not alone. Unveiling the language of price movements is where technical analysis comes in. Technical analysts use price charts and trading volume to predict trends and identify opportunities. Candlestick charts, with their unique visual format, are a cornerstone of this analysis. Each candlestick tells a mini-story, encapsulating the opening, closing, high, and low price points within a specific timeframe. Imagine these candles as mile markers on your financial journey. Spotting a steep descent ahead (a downtrend) is crucial for any savvy traveler. Similarly, for traders and investors, identifying potential downtrends is a game-changer. It empowers them to make informed decisions, like exiting positions to lock in profits or strategically entering short positions to capitalize on a potential decline. Here's where the bearish engulfing candle enters the scene. This distinctive pattern serves as a potential early warning signal, hinting at a shift in market sentiment from bullish optimism to bearish pessimism. Mastering the art of recognizing and interpreting this pattern can equip you with a valuable tool for navigating the ever-evolving market landscape.

Keys takeaways

- Spot the Shift: A bearish engulfing candle consists of a bullish candle followed by a larger bearish candle that engulfs the entire body and shadows of the first candle. It suggests a potential power shift from buyers to sellers.

- Downtrend Warning: This pattern can signal a potential reversal from an uptrend to a downtrend. However, confirmation from other technical indicators is crucial.

- Strategic Locations: The bearish engulfing candle holds more weight when it appears at swing highs or after extended uptrends, suggesting a loss of momentum in the uptrend.

- Not a Guarantee: Remember, no technical indicator is perfect. False signals can occur. Always practice proper risk management and consider confirmation techniques.

- Enhance Your Analysis: Combine the bearish engulfing candle with other reversal patterns like head and shoulders or double tops/bottoms to strengthen your technical analysis.

What is a Bearish Engulfing Candle?

How to Identify a Bearish Engulfing Candle

Significance of the Bearish Engulfing Candle

Where Does the Bearish Engulfing Candle Appear?

Limitations of the Bearish Engulfing Candle

Trading with the Bearish Engulfing Candle

Confirmation Techniques for the Bearish Engulfing Candle

Example:

Bearish Engulfing Candle vs. Bearish Harami

Case Study: Netflix's Bearish Engulfing Candle (2022)

Conclusion

What is a Bearish Engulfing Candle?

Imagine a tug-of-war between bulls (optimistic buyers) and bears (pessimistic sellers) in the stock market. The bearish engulfing candle depicts a dramatic power shift, potentially signaling a trend reversal. This two-candle pattern unfolds like a mini-drama. The first act features a bullish candle, typically green or white, indicating buying pressure and a price increase. But wait, there's a twist! The second act unveils a much larger bearish candle, often red or black. This dominant candle completely engulfs the entire body and shadows of the previous bullish candle, visually emphasizing the overpowering force of sellers driving the price down. This dramatic shift in dominance between buyers and sellers is the essence of the bearish engulfing candle, potentially foreshadowing a transition from an uptrend to a downtrend.

How to Identify a Bearish Engulfing Candle

Interested in identifying the bearish engulfing candle in the wild? Here's your field guide:- Spot the Bullish Predecessor: First, scan the chart for a bullish candle, typically green or white. This initial candle signifies a price increase, reflecting buying pressure.

- Enter the Bearish Force: The next act of the drama is the arrival of a much larger bearish candle, often colored red or black. This dominant candle should completely engulf the entire body of the preceding bullish candle.

- Shadows Tell the Tale: Pay close attention to the upper and lower shadows (wicks) of both candles. The bearish candle's shadows should also completely encompass those of the bullish candle, highlighting the sellers' overwhelming influence.

Significance of the Bearish Engulfing Candle

The bearish engulfing candle is a potential game-changer in technical analysis, acting as a beacon in the sea of price data. Its significance lies in its ability to signal a potential reversal from an uptrend to a downtrend.

Imagine a joyous celebration amongst buyers, reflected in a bullish candle. Suddenly, the bearish engulfing candle emerges, like a splash of cold water, signifying a shift in market psychology. Sellers overpower the bullish enthusiasm, driving the price down significantly. This dominance is visually depicted by the larger bearish candle engulfing the prior bullish one. It suggests a potential loss of confidence among buyers and a surge in selling pressure, potentially paving the way for a downtrend. While not a foolproof guarantee, the bearish engulfing candle serves as a valuable warning sign, prompting traders and investors to re-evaluate their positions and potentially adjust their strategies accordingly.Where Does the Bearish Engulfing Candle Appear?

The bearish engulfing candle holds the most weight when it appears at strategic junctures on a price chart. Imagine a mountain climber nearing the summit (swing high) after a long ascent (uptrend). The bearish engulfing candle is most impactful when it emerges at these swing highs or following extended uptrends.

Here's why:- Swing highs represent potential turning points where the uptrend might be losing momentum. The bearish engulfing candle appearing at this critical juncture suggests a potential shift in power, with sellers stepping in to overpower buyers and potentially drive the price down from its peak.

- Extended uptrends can create a sense of euphoria among buyers. The bearish engulfing candle, following a sustained period of price increases, acts as a potential reality check. It suggests that the bullish momentum might be waning, and sellers are ready to take control, potentially reversing the uptrend.

Limitations of the Bearish Engulfing Candle

The bearish engulfing candle, while a valuable tool, isn't a crystal ball. Like any technical indicator, it has limitations. False signals can occur, where the pattern appears but isn't followed by a downtrend. This is why confirmation becomes crucial. Look for additional supporting evidence to solidify the bearish engulfing candle's message. This might involve:

- Price action: Does the price break below a key support level after the engulfing candle?

- Volume: Does the bearish engulfing candle coincide with a surge in trading volume? Higher volume on the downside strengthens the selling pressure behind the pattern.

- Other technical indicators: Do indicators like the Relative Strength Index (RSI) or moving averages also suggest a potential downtrend?

Trading with the Bearish Engulfing Candle

The bearish engulfing candle can be a valuable tool for traders seeking to capitalize on potential downtrends. Here are some basic outlines for trading strategies based on this pattern:

- Entry Points: Consider entering a short position (selling an asset in anticipation of its price decline) after the bearish engulfing candle forms. However, to strengthen the signal, look for confirmation such as a price breakout below a key support level. This breakout signifies a confirmed downtrend and offers a more precise entry point.

- Stop-loss placement: A stop-loss order is crucial for risk management. Place it above the high of the bearish engulfing candle. If the price unexpectedly rallies, the stop-loss will automatically exit your trade, limiting potential losses.

- Position Sizing: Remember, even the most promising patterns can be wrong. Practice proper risk management by employing position sizing. Only allocate a small portion of your capital to each trade, protecting yourself from significant losses if the trade goes against you.

Confirmation Techniques for the Bearish Engulfing Candle

The bearish engulfing candle is a powerful signal, but even the strongest messages benefit from backup. To solidify the bearish engulfing candle's message and enhance your trading confidence, consider these confirmation techniques:

- Relative Strength Index (RSI) Divergence: The RSI measures price momentum and identifies overbought and oversold conditions. A bearish engulfing candle coinciding with negative divergence on the RSI is a strong sign. This means the price makes a new high (engulfing candle), but the RSI fails to reach a new high, indicating weakening buying momentum and potential for a reversal.

- Moving Average Crossovers: Moving averages smooth out price fluctuations and highlight trends. A bearish engulfing candle followed by a downward crossover of key moving averages (like the 50-day and 200-day) strengthens the bearish case. This crossover suggests a shift in momentum from bullish to bearish.

- Increased Bearish Volume: Don't underestimate volume! The bearish engulfing candle's significance is amplified by a surge in trading volume on the downside. This heavy selling volume underscores the dominance of sellers and strengthens the likelihood of a downtrend.

"Technical analyst Stephanie Ackerman emphasizes the importance of confirmation. 'While the bearish engulfing candle is a valuable reversal pattern, it's not infallible,' she cautions. 'By incorporating confirmation techniques like RSI divergence, moving average crossovers, and increased bearish volume, you can significantly improve the accuracy of your trade signals.'"

Example:

As you can see in the S&P 500 chart, there is a clear example of a bearish engulfing pattern. When a bearish engulfing pattern appears, the market trend changes, and it goes down.

Bearish Engulfing Candle vs. Bearish Harami

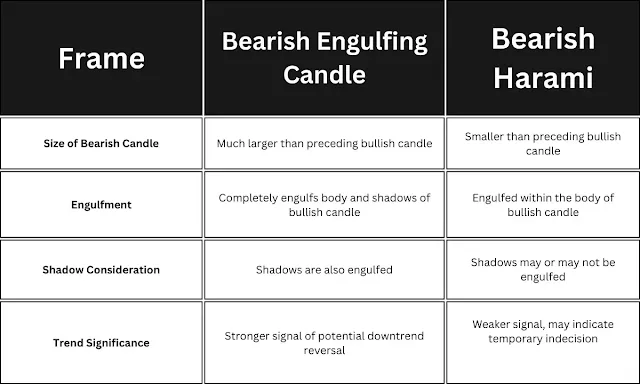

Discerning between reversal candlestick patterns can be tricky. The bearish engulfing candle and its close cousin, the bearish harami, both hint at potential downtrends, but with subtle variations. Here's a breakdown to help you tell them apart:

- Similarities: Both patterns involve a bullish candle followed by a bearish candle. They suggest a temporary pause in the uptrend, followed by a potential shift in dominance towards sellers.

- Key Differences: The bearish engulfing candle is the more dramatic of the two. The bearish candle completely engulfs the entire body and shadows of the preceding bullish candle, visually emphasizing the overpowering force of sellers. In contrast, the bearish harami features a smaller bearish candle that's engulfed within the body of the prior bullish candle, suggesting a less decisive shift in sentiment.

Let's solidify this with a table:

Case Study: Netflix's Bearish Engulfing Candle (2022)

Let's rewind to the summer of 2022. The streaming giant Netflix (NFLX) had been on a tear, its stock price soaring for most of the year. But as with all trends, even the hottest ones eventually cool down. In late July, a bearish candle emerged on the NFLX chart, indicating a shift in market sentiment.

Here's a closer look:

- Context: Before the engulfing candle, NFLX had enjoyed a sustained uptrend, fueled by optimism about subscriber growth.

- The Engulfing Candle: On July 26th, a large bearish candle emerged, completely engulfing the previous bullish candle's body and shadows. This dramatic visual shift indicated a surge in selling pressure, potentially signaling a loss of confidence among buyers.

- Confirmation: Adding weight to the bearish engulfing candle's message was a significant increase in trading volume on the downside. This heavy selling volume underscored the dominance of sellers and the potential for a trend reversal.

- The Downtrend: Following the bearish engulfing candle, NFLX's stock price embarked on a steady decline in the coming months, a trend that continued into 2023. This historical example highlights the potential significance of the bearish engulfing candle in identifying potential trend reversals. It's important to keep in mind that technical analysis is not an exact science and that it is necessary to seek confirmation from other indicators and implement proper risk management before making any investment decisions.

Can it be used in any timeframe?

Absolutely! The bearish engulfing candle can be spotted on various timeframes, from short-term charts like 1-minute intervals to long-term charts like monthly ones. However, the significance of the pattern often increases on higher timeframes, as it suggests a more substantial shift in market sentiment.

How reliable is the bearish engulfing candle?

No technical indicator is foolproof. While the bearish engulfing candle is a valuable tool, it can sometimes lead to false signals. Confirmation from other indicators like increased bearish volume, RSI divergence, or moving average crossovers can significantly boost its reliability.

What other reversal patterns should I be aware of?

- Head and Shoulders: This pattern resembles a head with two shoulders, signifying a potential trend reversal from uptrend to downtrend.

- Doji: This unique cross-shaped candle reflects indecision in the market, potentially hinting at a reversal.

- Double Top/Bottom: Two consecutive highs or lows with failing attempts to break through resistance or support can suggest a potential reversal.

By incorporating these additional patterns and using them in conjunction with the bearish engulfing candle, you'll be well on your way to becoming a more versatile technical analyst. So, keep exploring, keep learning, and conquer the ever-evolving market!

Conclusion

The financial markets can be unpredictable, but with the right tools, you can navigate this wild ride with more confidence. The bearish engulfing candle emerges as a valuable weapon in your technical analysis arsenal. This two-candle pattern, where a dominant bearish candle engulfs a preceding bullish candle, serves as a potential early warning signal. It whispers of a battle brewing between optimistic buyers and pessimistic sellers, hinting at a possible shift from an uptrend to a downtrend.Remember, the bearish engulfing candle is not a crystal ball. It can provide valuable clues, but confirmation from other indicators and sound risk management is essential. However, by understanding this pattern and incorporating it into your technical analysis routine, you'll be better equipped to navigate potential downtrends and identify opportunities within the ever-evolving market landscape. So, the next time you encounter a bearish engulfing candle, view it not as a harbinger of doom, but as a potential turning point – a chance to refine your strategy and potentially position yourself for future success.