Edited & Reviewed by: Taranjit Singh

Introduction to Candlestick Patterns

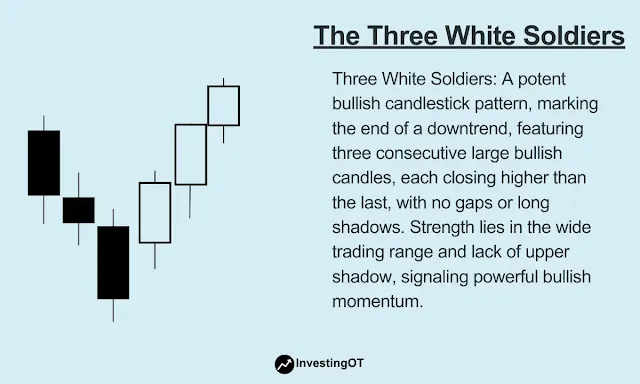

Candlestick patterns are a crucial part of technical analysis, providing traders with visual representations of price movements. These patterns can help identify trends, reversals, and continuations in the market, making them invaluable tools for traders of all levels.What are the Three White Soldiers?

The Three White Soldiers is a bullish reversal candlestick pattern consisting of three consecutive long green (or white) candles. Each candle opens within the body of the previous candle and closes higher than the previous close, indicating a strong upward trend.Key Takeaways

- The Three White Soldiers is a bullish candlestick pattern that signals a potential reversal in a downtrend.

- It consists of three consecutive long-bodied green candles that open within the previous candle's real body and close above the previous candle's high.

- Ideally, the candles should have small or no shadows and open within the real body of the preceding candle.

- The pattern may indicate a strong change in market sentiment and can be used as a potential entry or exit point for a trade.

- Traders should consider other factors, such as volume and resistance levels, before making a decision.

- The opposite pattern is the Three Black Crows, which indicates a bearish reversal.

- Three White Soldiers can also appear during consolidation, so it's essential to confirm the pattern with other technical indicators.

Components of the Three White Soldiers

To accurately identify the Three White Soldiers pattern, it's essential to understand its components:- Three Long Green Candles: Each candle should be significantly larger than the average candle size in the preceding trend.

- Higher Closes: Each candle should close higher than the previous candle's close.

- Open Within the Previous Candle's Body: Each candle should open within the body of the previous candle, demonstrating a consistent upward trend.

Identifying the Three White Soldiers

To identify the Three White Soldiers pattern, follow these steps:

- Look for three consecutive long green candles.

- Ensure each candle opens within the body of the previous candle.

- Confirm that each candle closes higher than the previous candle's close.

The Psychology Behind the Three White Soldiers

The Three White Soldiers pattern reflects a shift in market sentiment from bearish to bullish. As buyers gain control, they drive prices higher, creating a series of long green candles. This pattern indicates that buyers are increasingly confident and willing to pay higher prices for the asset.

For advanced traders: Combine Three White Soldiers with a bullish divergence in a momentum indicator, such as the Relative Strength Index (RSI), to enhance the accuracy of your bullish reversal trades. This potent combination can help filter out false signals and improve risk-reward ratios.

Examples of the Three White Soldiers

The Three White Soldiers pattern can appear in various financial markets, including stocks, forex, and cryptocurrencies. Here's an example of the pattern in Tradingview chart:Trading Strategies Using the Three White Soldiers

Traders can use the Three White Soldiers pattern to enter long positions or exit short positions. Here are some strategies to consider:- Long Entry: Enter a long position when the third candle of the pattern forms, placing a stop-loss below the recent low.

- Short Exit: If you're holding a short position, consider closing it when the Three White Soldiers pattern appears, as it indicates a potential trend reversal.

- Confirmation: Wait for additional confirmation, such as a bullish moving average crossover or a breakout above a resistance level, before entering a long position.

Three White Soldiers vs. Other Bullish Patterns

The Three White Soldiers pattern is similar to other bullish reversal patterns, such as the Bullish Engulfing and the Piercing Line. However, the Three White Soldiers pattern is more robust, as it consists of three consecutive green candles, providing a stronger indication of a bullish reversal.Limitations and Considerations

While the Three White Soldiers pattern is a powerful tool, it's not foolproof. Consider the following limitations and considerations:- Volume: Ideally, the Three White Soldiers pattern should be accompanied by an increase in trading volume, indicating strong buyer interest.

- Context: The pattern's effectiveness may vary depending on the market context, such as the overall trend and the presence of other technical indicators.

- False Signals: Like any technical indicator, the Three White Soldiers pattern can produce false signals, so it's essential to use it in conjunction with other tools and strategies.

What is the Three White Soldiers pattern?

The Three White Soldiers pattern is a bullish candlestick pattern that consists of three consecutive long-bodied green candles. Each candle opens within the previous candle's real body and closes above the previous candle's high.

What does the Three White Soldiers pattern indicate?

The Three White Soldiers pattern indicates a potential reversal in a downtrend and a strong change in market sentiment.

How can traders use the Three White Soldiers pattern?

Traders can use the Three White Soldiers pattern as a potential entry or exit point for a trade. However, they should consider other factors, such as volume and resistance levels, before making a decision.

What is the opposite of the Three White Soldiers pattern?

The opposite of the Three White Soldiers pattern is the Three Black Crows pattern, which indicates a bearish reversal.

Can the Three White Soldiers pattern appear during consolidation?

Yes, the Three White Soldiers pattern can appear during consolidation, so it's essential to confirm the pattern with other technical indicators.

What are some other technical indicators that traders can use with the Three White Soldiers pattern?

Traders can use technical indicators, such as trendlines, moving averages, and bands, in conjunction with the Three White Soldiers pattern. They can also look at the level of volume on the breakout to confirm that there was a high amount of dollar volume during the move.

What are some other chart patterns that are similar to the Three White Soldiers pattern?

Some other chart patterns that are similar to the Three White Soldiers pattern include the Three Black Crows, the Bullish Engulfing Pattern, the Morning Star, the Hammer and Inverted Hammer, the Piercing Line, the Abandoned Baby, Tweezer Bottoms, and Tops, as well as the Double Bottom and Double Top.

How can traders improve the reliability of the Three White Soldiers pattern?

Traders can improve the reliability of the Three White Soldiers pattern by incorporating additional technical indicators, volume analysis, and contextual market conditions. They should also look for areas of upcoming resistance before initiating a long position and confirm that there was a high amount of dollar volume during the move.

What is the effectiveness of the Three White Soldiers pattern depending on the asset's liquidity, volatility, and market conditions?

The effectiveness of the Three White Soldiers pattern may vary depending on the asset's liquidity, volatility, and market conditions. It may be more effective in some markets than others, so traders should consider these factors when using the pattern.

Conclusion: The Legacy of the Three White Soldiers

The Three White Soldiers pattern is a powerful and enduring tool in technical analysis. By understanding its components, identifying it correctly, and incorporating it into a well-rounded trading strategy, traders can harness the pattern's potential to predict bullish reversals and capitalize on market opportunities.While no single indicator can ensure success, the Three White Soldiers pattern has proven its worth as a reliable and valuable tool for traders seeking to navigate the complexities of financial markets. By mastering the Three White Soldiers pattern, traders can enhance their understanding of market dynamics and improve their overall trading performance.